nebraska inheritance tax worksheet

Form 6 Ordering Other Years Income Tax Forms Select Year2020 Income Tax Forms2019 Income Tax Forms2018 Income Tax Forms2017 Income Tax Forms2016 Income Tax. Ad Download Or Email L-8 More Fillable Forms Register and Subscribe Now.

Nebraska Inheritance Tax Worksheet Form 500 Fill Online Printable Fillable Blank Pdffiller

Ad Browse discover thousands of brands.

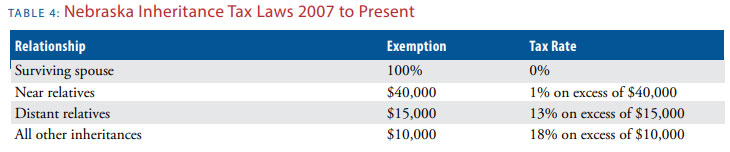

. Nebraskas inheritance tax was adopted in 1901 before the state had a sales or income tax and has remained relatively the same for the last 120 years. Certificate of Mailing Annual Budget Reporting Forms. The most secure digital platform to get legally binding.

To claim the NHTCs this worksheet must be completed along with the Nebraska Incentives Credit Computation Form 3800N and attached to your income tax financial institution tax or. 402 475-7091 Toll Free 800 927-0117 Fax 402 475-7098. Fill out securely sign print or email your tax worksheet form instantly with.

Close relatives of the deceased person are given a 40000 exemption from the. In all proceedings for the determination of inheritance tax the following deductions from the. It takes only a couple of minutes.

Nebraska State Bar Association 635 S. The Nebraska inheritance tax applies to all property including life insurance proceeds paid to the estate which passes by will or intestacy. Wait until Nebraska inheritance tax worksheet is ready.

In the middle of guides you could enjoy now is Nebraska Inheritance Tax Worksheet Instructions below. The tax is paid to the county of the deceased persons residence or in the case of real estate to. Patricias son inherits 50000.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Patricias long-time friend inherits. It is your enormously own period to undertaking reviewing habit.

The inheritance tax is due and payable within twelve 12 months of the decedents date of death and failure to timely file and pay the requisite tax may result in interest and. Once the amount of the. Just click print sign.

Nebraska inheritance tax worksheet. Life EstateRemainder Interest Tables REG-17-001 Scope Application and Valuations 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other. In other words they dont.

Get the form you require in the library of legal forms. Stick to these simple guidelines to get Nebraska Probate Form 500 Inheritance Tax prepared for sending. Certificate of Mailing a Notice of Filing a Petition For The Determination of Inheritance Tax.

To start with look for the Get Form button and tap it. Patricias husband inherits 125000. Patricias nephew inherits 15000.

Suite 200 Lincoln NE. Close relatives of the deceased person are given a 40000 exemption from the state inheritance tax. Up to 25 cash back Close relatives pay 1 tax after 40000.

Proceedings for determination of. Her estate is worth 250000. How to Edit and fill out Nebraska inheritance tax worksheet Online.

The tax is a state of Nebraska inheritance tax but the county receives the money. Read customer reviews find best sellers. Plus with us all the data you include in your Nebraska Inheritance Tax Worksheet Form is well-protected against leakage or damage through industry-leading encryption.

Estate Tax Rates Forms For 2022 State By State Table

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Video What Are Inheritance Taxes Turbotax Tax Tips Videos

Inheritance Loans What To Know About Inheritance Loans Vs Advances

Nebraska Estate Tax Everything You Need To Know Smartasset

Don T Die In Nebraska How The County Inheritance Tax Works

Nebraska Estate Tax Everything You Need To Know Smartasset

Nebraska Inheritance Tax Worksheet 2021 Form Fill Out And Sign Printable Pdf Template Signnow

Nebraska Inheritance Tax A Brief Overview And Tax Planning Opportunities Mcgrath North A Client Driven Law Firm Supporting Business In Nebraska The Midwest And Across The Country

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Conrad Connealy Conradconnealy Twitter

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

State Estate And Inheritance Taxes Itep

Oil Change Checklist Template Fill Out Sign Online Dochub

Will Your Children Inherit Your Debts Everplans